Is Retirement Income Taxable In South Carolina . Social security benefits are not taxed, and while retirement income is. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. If you are under 65, you can deduct up to. south carolina is very tax friendly for retirees. south carolina allows for a deduction in retirement income based off of your age. South carolina offers a retirement income exclusion of up to $10,000. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. It provides a substantial deduction on. is retirement income taxed in south carolina? South carolina does not tax social security retirement benefits whatsoever.

from 401kspecialistmag.com

52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. South carolina does not tax social security retirement benefits whatsoever. south carolina allows for a deduction in retirement income based off of your age. If you are under 65, you can deduct up to. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. South carolina offers a retirement income exclusion of up to $10,000. south carolina is very tax friendly for retirees. is retirement income taxed in south carolina? It provides a substantial deduction on. Social security benefits are not taxed, and while retirement income is.

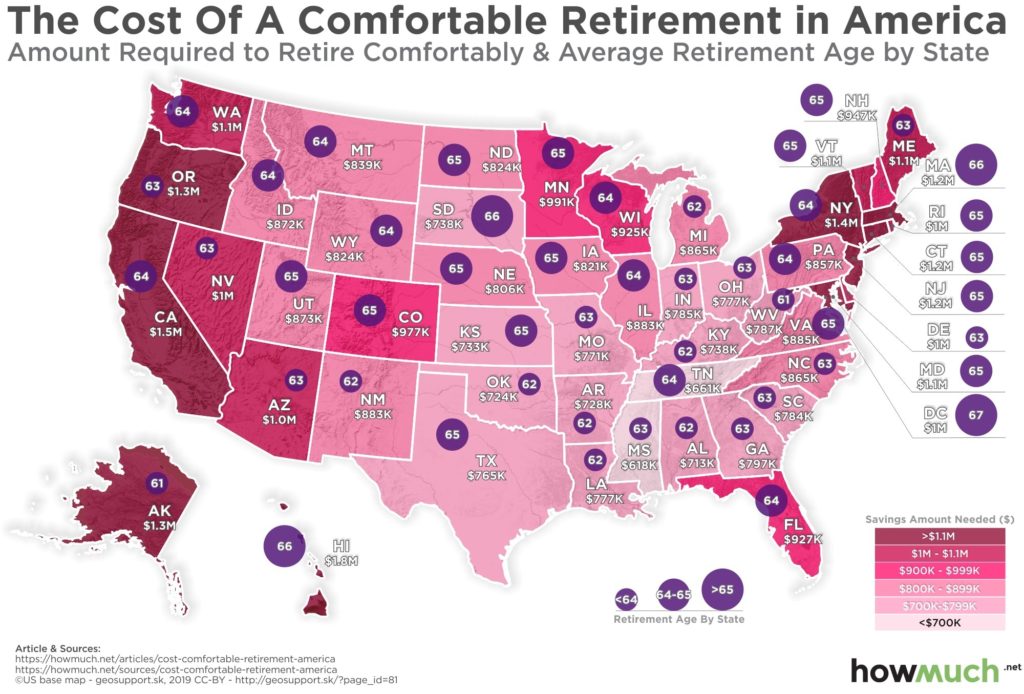

Most and Least Expensive States for Retirement 2020 401K Specialist

Is Retirement Income Taxable In South Carolina South carolina does not tax social security retirement benefits whatsoever. South carolina does not tax social security retirement benefits whatsoever. south carolina is very tax friendly for retirees. south carolina allows for a deduction in retirement income based off of your age. is retirement income taxed in south carolina? If you are under 65, you can deduct up to. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. South carolina offers a retirement income exclusion of up to $10,000. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. Social security benefits are not taxed, and while retirement income is. It provides a substantial deduction on.

From www.eunduk.com

세 종류의 각 소득에 대한 택스는? Is Retirement Income Taxable In South Carolina is retirement income taxed in south carolina? social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. If you are under 65, you can deduct up to. It provides a substantial deduction on. south carolina allows for a deduction in retirement income based off of your age. 52. Is Retirement Income Taxable In South Carolina.

From slideplayer.com

South Carolina Return. ppt download Is Retirement Income Taxable In South Carolina 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. South carolina does not tax social security retirement benefits whatsoever. It provides a substantial deduction on. is retirement income taxed in south carolina? South carolina offers a retirement income exclusion of up to $10,000. social security benefits and. Is Retirement Income Taxable In South Carolina.

From www.cashay.com

Map Here are the best and worst U.S. states for retirement Cashay Is Retirement Income Taxable In South Carolina south carolina allows for a deduction in retirement income based off of your age. South carolina does not tax social security retirement benefits whatsoever. If you are under 65, you can deduct up to. It provides a substantial deduction on. is retirement income taxed in south carolina? south carolina is very tax friendly for retirees. South carolina. Is Retirement Income Taxable In South Carolina.

From slideplayer.com

South Carolina Return. ppt download Is Retirement Income Taxable In South Carolina South carolina offers a retirement income exclusion of up to $10,000. south carolina is very tax friendly for retirees. south carolina allows for a deduction in retirement income based off of your age. If you are under 65, you can deduct up to. South carolina does not tax social security retirement benefits whatsoever. social security benefits and. Is Retirement Income Taxable In South Carolina.

From www.olderaleighfinancial.com

Raleigh NC Financial Advisor Is Retirement Taxable? Is Retirement Income Taxable In South Carolina South carolina offers a retirement income exclusion of up to $10,000. south carolina is very tax friendly for retirees. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. Social. Is Retirement Income Taxable In South Carolina.

From 401kspecialistmag.com

Most and Least Expensive States for Retirement 2020 401K Specialist Is Retirement Income Taxable In South Carolina If you are under 65, you can deduct up to. south carolina allows for a deduction in retirement income based off of your age. south carolina is very tax friendly for retirees. Social security benefits are not taxed, and while retirement income is. social security benefits and railroad retirement taxed for federal purposes are not subject to. Is Retirement Income Taxable In South Carolina.

From taxfoundation.org

2020 State Individual Tax Rates and Brackets Tax Foundation Is Retirement Income Taxable In South Carolina south carolina is very tax friendly for retirees. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. South carolina does not tax social security retirement benefits whatsoever. South carolina offers a retirement income exclusion of up to $10,000. is retirement income taxed in south carolina? south. Is Retirement Income Taxable In South Carolina.

From slideplayer.com

South Carolina Return. ppt download Is Retirement Income Taxable In South Carolina South carolina offers a retirement income exclusion of up to $10,000. is retirement income taxed in south carolina? If you are under 65, you can deduct up to. south carolina is very tax friendly for retirees. South carolina does not tax social security retirement benefits whatsoever. It provides a substantial deduction on. social security benefits and railroad. Is Retirement Income Taxable In South Carolina.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 Finapress Is Retirement Income Taxable In South Carolina 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. South carolina offers a retirement income exclusion of up to $10,000. is retirement income taxed in south carolina? south. Is Retirement Income Taxable In South Carolina.

From smartzonefinance.com

The Most Common Sources Of Retirement SmartZone Finance Is Retirement Income Taxable In South Carolina south carolina allows for a deduction in retirement income based off of your age. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. is retirement income taxed in south carolina? South carolina offers a retirement income exclusion of up to $10,000. If you are under 65, you can. Is Retirement Income Taxable In South Carolina.

From retiregenz.com

How Much Will My Pension Be Taxed In South Carolina? Retire Gen Z Is Retirement Income Taxable In South Carolina South carolina offers a retirement income exclusion of up to $10,000. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. Social security benefits are not taxed, and while retirement income is. If you are under 65, you can deduct up to. It provides a substantial deduction on. is. Is Retirement Income Taxable In South Carolina.

From www.southernheritageins.com

TaxDeferred Retirement Southern Heritage Insurance Is Retirement Income Taxable In South Carolina 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. South carolina does not tax social security retirement benefits whatsoever. If you are under 65, you can deduct up to. south carolina is very tax friendly for retirees. social security benefits and railroad retirement taxed for federal purposes. Is Retirement Income Taxable In South Carolina.

From tammaqjoannes.pages.dev

Best Place To Retire In South Carolina 2025 Ricca Pansie Is Retirement Income Taxable In South Carolina social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. South carolina does not tax social security retirement benefits whatsoever. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. south carolina is very tax friendly for retirees. It provides. Is Retirement Income Taxable In South Carolina.

From www.agingenergized.com

StatebyState Guide to Taxes on Retirees Is Retirement Income Taxable In South Carolina It provides a substantial deduction on. Social security benefits are not taxed, and while retirement income is. South carolina offers a retirement income exclusion of up to $10,000. south carolina is very tax friendly for retirees. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. 52 rows all. Is Retirement Income Taxable In South Carolina.

From perriytorrie.pages.dev

Social Security Max 2024 Withholding Amount Mara Kikelia Is Retirement Income Taxable In South Carolina South carolina does not tax social security retirement benefits whatsoever. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. south carolina is very tax friendly for retirees. South carolina offers a retirement income exclusion of up to $10,000. Social security benefits are not taxed, and while retirement income. Is Retirement Income Taxable In South Carolina.

From www.foxbusiness.com

Your retirement distributions won't be taxed in these states AARP Is Retirement Income Taxable In South Carolina If you are under 65, you can deduct up to. South carolina offers a retirement income exclusion of up to $10,000. South carolina does not tax social security retirement benefits whatsoever. south carolina allows for a deduction in retirement income based off of your age. 52 rows all residents over 65, are eligible for an income tax deduction. Is Retirement Income Taxable In South Carolina.

From slideplayer.com

South Carolina Return. ppt download Is Retirement Income Taxable In South Carolina Social security benefits are not taxed, and while retirement income is. If you are under 65, you can deduct up to. south carolina is very tax friendly for retirees. 52 rows all residents over 65, are eligible for an income tax deduction of $15,000, reduced by retirement income. It provides a substantial deduction on. South carolina does not. Is Retirement Income Taxable In South Carolina.

From www.youtube.com

Railroad Retirement and Federal Taxes YouTube Is Retirement Income Taxable In South Carolina South carolina does not tax social security retirement benefits whatsoever. south carolina is very tax friendly for retirees. Social security benefits are not taxed, and while retirement income is. social security benefits and railroad retirement taxed for federal purposes are not subject to tax in south carolina. is retirement income taxed in south carolina? south carolina. Is Retirement Income Taxable In South Carolina.